Ratibi / FAB Card Balance Check

Enter your Card Details

Managing your finances becomes a lot easier when you know exactly how much is available in your account at any moment. Many people in the UAE depend on FAB for their daily banking needs. The bank provides several convenient tools that help customers stay updated on their spending. Whether you prefer using your phone, an ATM, or an online platform, FAB offers simple ways to view your account details.

FAB Balance Check – Easy Salary Enquiry Within 1 Minute

This guide explains every FAB balance check method in clear steps so that you can monitor your funds with confidence and avoid any unexpected issues.

What Is FAB Bank Balance Check?

You can check your FAB bank balance in a number of ways. This procedure allows you to confirm recent transactions, track spending, and ensure that your salary or transfer has been received. For a full breakdown of your recent activity, you can also get your FAB bank statement online, which provides a detailed record of all transactions.

FAB provides several simple methods for balance checking so that every customer can choose the option that suits their routine.

This includes digital channels, ATMs, and dedicated services for salary and prepaid cards. As a result, the process is quick and accessible to all account holders.

FAB Bank Balance Check – Quick & Easy Methods

FAB offers several simple options that allow customers to check their account balance within seconds. Here is a quick list of all the methods.

- FAB Online Banking

- FAB Mobile App

- SMS Banking

- ATM

- Phone Banking / IVR

- Payit App

Check FAB Balance Through Website

By using the website, you can easily check your FAB bank balance without installing any applications. Here is a step-by-step process.

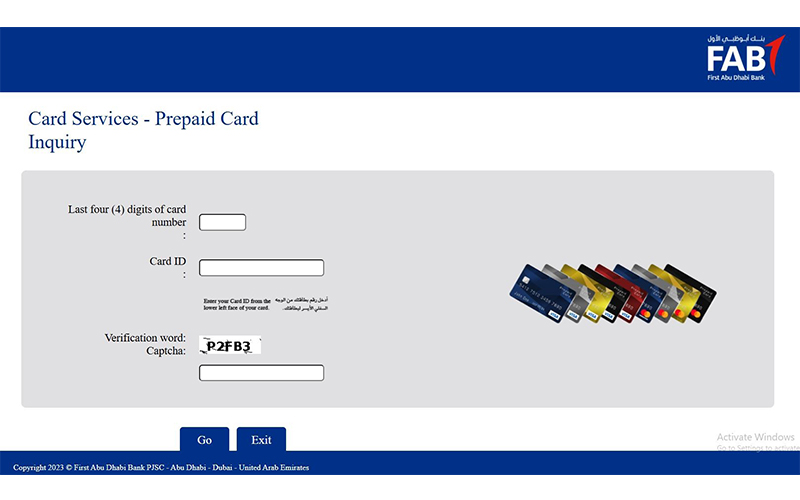

Step 01: Open the official FAB website in your browser by selecting the button below. You will see two empty boxes on this page.

Step 02: Enter the last four digits of your prepaid or Ratibi card number in the first field.

Step 03: Type your 16-digit ID card number into the next field. You can find this number on the lower left hand side of your card.

Step 04: Enter the captcha code and review the information you entered to confirm that everything is correct.

Step 05: After that, hit the ‘Go’ button on the screen to view your card balance and recent details.

Check FAB Balance Using Mobile App

You can check your FAB account balance at any time using the bank’s mobile application. Follow the simple steps outlined below.

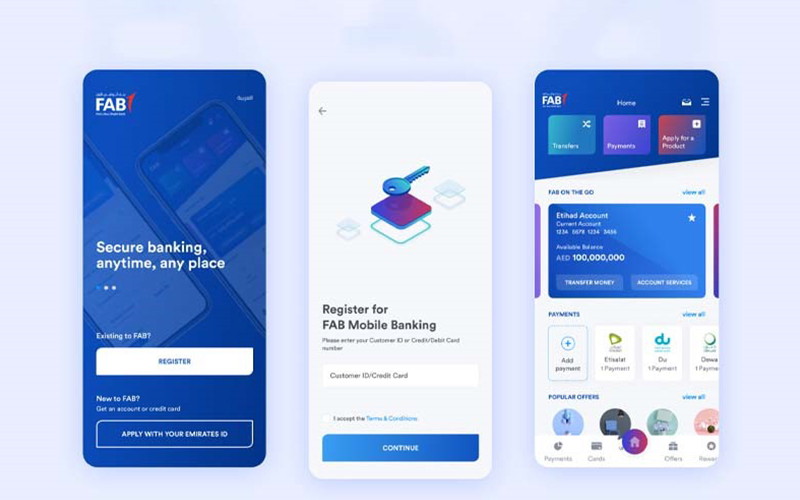

Step 01: Download the FAB Mobile App from the App Store or Google Play Store, then install it on your device with a stable internet connection.

Step 02: Open the app and select the option to register or login, then enter your customer ID or debit card number to proceed with the verification steps.

Step 03: Confirm your identity by entering the OTP sent to your registered mobile number, then set your login credentials if you are a new user.

Step 04: Once you are logged in, open the ‘Accounts’ section and select your account to view your updated balance and recent transactions.

FAB Balance Check via SMS

SMS banking is a convenient option that lets you perform a quick FAB bank balance check through a text message. Here are the steps:

Step 01: Make sure your mobile number with Etisalat or du is already registered for FAB SMS banking, since the service works only with a registered number.

Step 02: Type a new message in the format ‘BAL’ followed by a space and the last four digits of your account number. For example, you could write BAL 0101.

Step 03: Send this message to ‘2121‘ from the same registered mobile number linked to your FAB account.

Step 04: Wait for a few seconds and you will receive an SMS showing your available balance on your registered phone.

Check FAB Account Balance Using ATM

ATMs offer a quick way to check your FAB account balance without using online services.

Step 01: Visit any FAB ATM and insert your debit card to access the menu.

Step 02: Select the ‘Balance Inquiry’ option from the given choices.

Step 03: Now enter your ATM PIN and view your current balance or print a receipt if you need a copy.

FAB Balance Check via Phone Banking / IVR

Phone banking is a practical option for those who prefer doing their FAB bank balance checking via phone call instead of using digital services. You can reach the FAB customer service team inside the UAE by dialing 600525500.

If you are outside the country, FAB also provides an international support line which you can reach at +971 2 6811511.

Once you call, the automated system guides you through simple menu steps to hear your balance. You may speak with a representative for additional help after identity verification.

FAB Balance Check for Payit Wallet Users

Here’s how to check your balance with the Payit Wallet

Step 01: Install and open the Payit app on your phone, then login using your registered mobile number or linked FAB account credentials.

Step 02: Link your FAB account, salary card, or prepaid card (such as Ratibi or DWallet) with Payit, if it’s not already linked.

Step 03: Once linked, proceed to the “Wallet Balance” or “Accounts” section in the app to view your current balance and recent transactions.

Step 04: For salary users on Payit Plus Account, Payit instantly reflects salary credits once they arrive. This gives you instant access to funds.

FAB Ratibi Card Salary Check

The Ratibi Card from FAB is a prepaid salary card designed for employees earning up to AED 5,000 per month, especially those who do not have a regular bank account. If you want to compare it with other prepaid salary options, you can check FAB prepaid and Ratibi salary card details for a complete overview. Once your employer deposits your salary onto the card, you can conveniently check your balance and transaction details through several available methods.

By simply entering your card information such as the last four digits and your 16-digit Card ID you can instantly view your balance via the bank’s official online inquiry portal. You can also stay updated on your available funds through the FAB app, supported ATMs, or SMS notifications if your number is registered.

What are the steps to opening a bank account with FAB?

UAE residents can open a bank account with FAB easily. You can choose the method that feels most convenient for your routine.

- Visit any FAB branch and apply directly with the help of a customer service officer.

- Apply online through the FAB website by submitting your basic information and uploading your documents.

- Use the bank’s mobile app to start the account opening process and complete digital verification.

- Apply through selected FAB kiosks or service centers where digital account opening is supported.

To open a FAB account, you will need your Emirates ID, passport copy, residency visa page, and proof of income such as a salary certificate or employment contract.

Some account types may also require your Emirates ID verification at a branch before activation.

How do I activate my FAB Mobile Banking account?

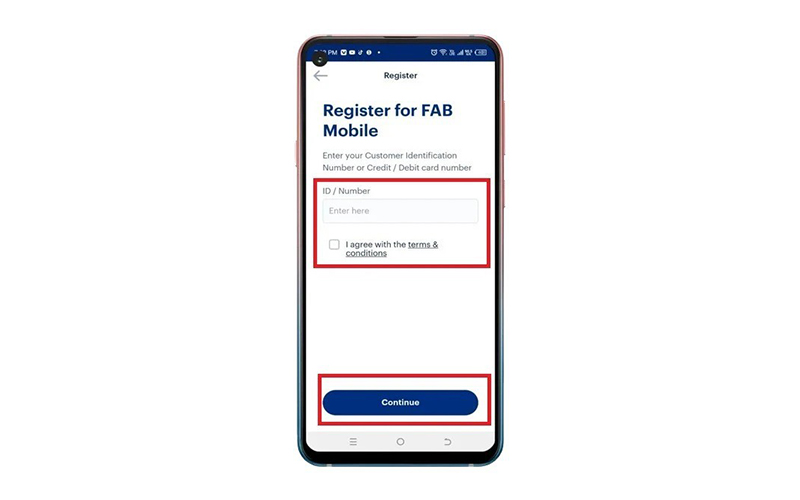

Activating your FAB Mobile Banking account is a quick process that requires only your registered mobile number and basic account details. The following is a step-by-step guide:

Step 01: Download the FAB Mobile app from the App Store or Google Play Store.

Note: If you haven’t created your account yet, you can easily apply for a FAB bank account online and gain access to all FAB digital banking features, including balance checks through the mobile app.

Step 02: Open the app and select the option to register for mobile banking.

Step 03: Enter your debit card details or customer number along with your registered mobile number.

Step 04: Type the OTP sent to your phone to verify your identity.

Step 05: Create your username and password to complete the activation process.

After registering with FAB Bank, you can check your balance, send or receive money, and pay bills with the app.

How to Check FAB Salary Account Balance?

There are several methods you can use to check the balance of your salary account. So you can choose the one that is most convenient for you.

- Use the FAB Mobile App by logging in and selecting your salary account from the dashboard.

- Login to FAB Online Banking and open the ‘Accounts’ section to view your updated balance.

- Visit any FAB ATM, insert your salary card, and select the ‘Balance Inquiry’ option.

- For Ratibi or prepaid salary cards, use the official FAB balance inquiry page by entering your card details.

What is FAB Swift Code?

The FAB Swift Code is NBADAEAAXXX, and it identifies First Abu Dhabi Bank in the international banking system.

This code is required whenever you receive money from overseas or send funds to a foreign bank.

It ensures that your transfer reaches the correct bank and the correct branch without delay. The Swift Code acts as a global identifier, which means international payments, salary transfers, and remittances cannot be processed securely without it.

Conclusion

Managing your FAB account balance becomes easier when you use a method that fits your daily routine.

FAB offers several reliable options that help you stay in control of your finances at all times.

If you need assistance with any service or balance related query, you can contact our customer support for guidance.