Managing your finances becomes far easier when your bank gives you the flexibility to handle everything online. In today’s fast-paced lifestyle, people expect quick access to their money, smooth transactions, and reliable digital banking tools. That’s exactly why so many UAE residents turn to First Abu Dhabi Bank. FAB allows you to open your account completely online, giving you instant access to important features from day one.

Once your account is active, you’ll be able to make payments, review transactions, and even check your FAB bank balance online with just a few taps.

How to Open a FAB Bank Account in 2026?

To avoid delays or rejections, it’s important to know the required documents, eligibility rules, and the steps for both online and offline applications.

This guide explains everything clearly so you can get to know How to Open a FAB Bank Account quickly and confidently.

How to Open a FAB Bank Account in 2026?

To create a FAB account online, the bank allows you to apply through its official website or via the FAB Mobile App. This makes the entire process digital from start to finish.

Using the Website

Below is a detailed breakdown of each step you’ll follow when opening a FAB account through the official website.

Step 01: Visit the Official FAB Website

You can begin by clicking the button below, then selecting ‘Apply Now’.

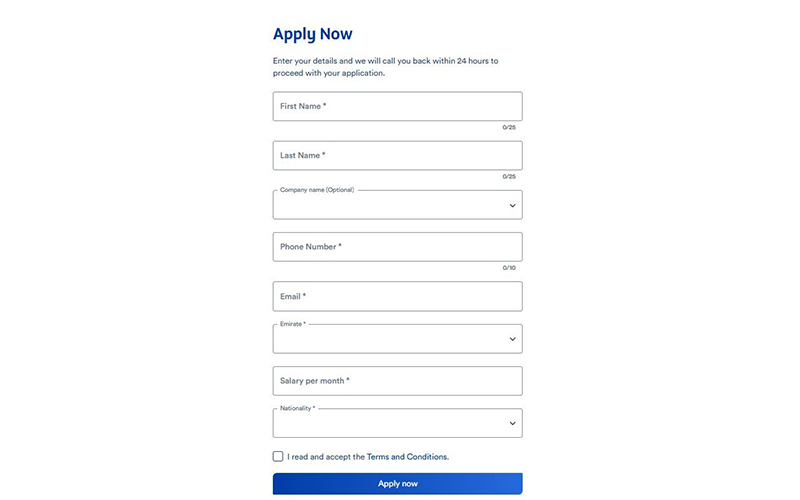

Step 02: Fill Out the Online Application Form

Provide your personal details: name, contact number, email, residence in the Emirates, monthly salary, nationality, and any other requested information. You will then need to check the terms and conditions box and click ‘Apply Now.’

Step 04: Upload Required Documents

Upload scanned copies (or digital photos) of the required documents: valid Emirates ID, passport + visa page or residence visa, proof of address (if asked), salary certificate or proof of income (if required), and any other documents depending on the account type.

Step 05: Review Your Details & Submit the Application

Carefully review all the information you have entered to ensure its correctness. Once everything is accurate and all uploads are complete, submit the application.

Step 06: Wait for FAB Verification

After submission, FAB will review your application and documents. They might contact you by email or phone if they need additional details or clarifications. After your new account is activated, you can also access your FAB bank statement online to review your transactions and keep track of your finances easily.

Using FAB Mobile App

Below are the exact steps you’ll have to follow:

Step 01: Download and Launch the FAB Mobile App

Install the FAB Mobile app from the App Store or Google Play. Open it and select “Join FAB” on the home screen.

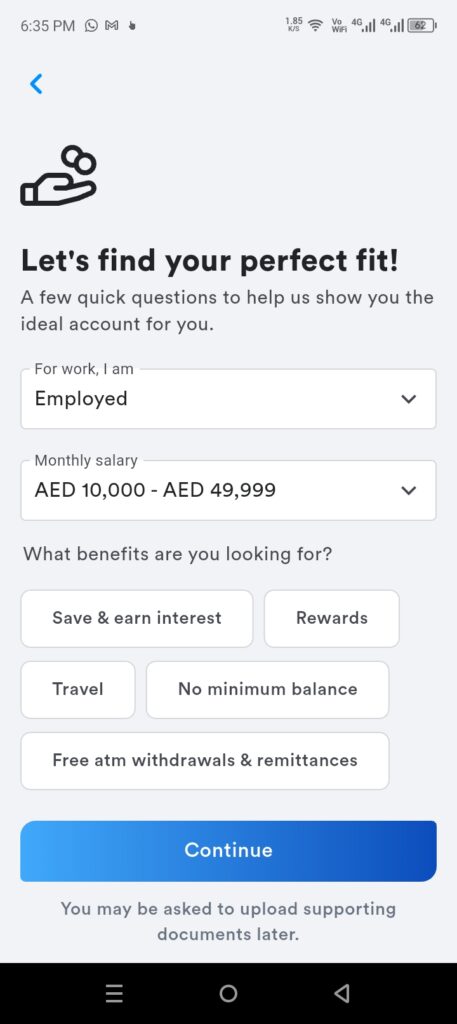

Step 02: On the next step, you’ll be asked to choose between ‘FAB‘ and ‘FAB Islamic‘. Select the standard ‘FAB‘ option to continue.

Step 03: You’ll then be presented with three choices: open a bank account, apply for a credit card, or open an account with a credit card together. Since you’re only opening an account, choose the first option and fill out the form with your correct details.

Step 04: Scan Your Emirates ID: After that, the bank will ask you to verify your identity. Use the app to scan both sides of your Emirates ID. In just a few seconds, your personal information will be filled in automatically.

Step 05: Upload Essential Documents

Submit digital copies of your passport and visa page. Proof of address may be requested depending on your account type.

Step 06: Complete Facial Verification

Take a quick selfie for identity verification. The app matches it with your Emirates ID for security.

Step 07: Choose Your Account Type & Submit

Select the account you want, confirm your details, and hit ‘Submit’. FAB will notify you once the account is approved.

How to Open a FAB Account in a Branch?

Those who are looking for personal assistance or who have specific financial needs might benefit from opening a FAB account at a branch.

To begin, visit your nearest FAB branch through the locator below with all essential documents, including your Emirates ID, passport, visa page, and proof of address.

A customer service officer will guide you through the application form, verify your identity through biometrics, and review your documents on the spot.

If everything is in order, your account is usually approved the same day. You’ll receive details about when your debit card will be ready for collection or delivery.

Eligibility Criteria

FAB has clear eligibility requirements to ensure that applicants meet basic identification and residency standards. These criteria help the bank verify your identity and determine the type of account you qualify for. Here are a few key eligibility criteria:

- Must be at least 18 years old

- Valid Emirates ID

- Valid UAE residence visa (for expatriates)

- UAE address

- Minimum salary requirements (for salary accounts).

Required Documents

Visiting a FAB branch is an ideal option if you prefer personal assistance or need help with specific account requirements. The process is fairly simple as long as you bring the following documents with you.

- Emirates ID

- Passport

- UAE residence visa page

- Proof of address

- Salary certificate (if opening a salary account)

With these documents ready, the bank officer will guide you through the application and complete the procedure on spot. If you’re still deciding which type of card suits your needs, reviewing a quick FAB prepaid vs Ratibi salary card comparison can help you understand the differences before opening an account.

Fees & Charges to Know

FAB applies certain fees and charges depending on account type. You can review the complete, updated list through the button provided below.

Conclusion

Opening a FAB bank account is a simple process as long as you understand the requirements and choose the method that suits you best.

Whether you apply online or visit a branch, having the right documents and eligibility information makes the entire experience faster and smoother.

With its strong digital tools, wide branch network, and trustworthy services, FAB remains a reliable and trusted option for banking in the UAE.